Can 529 Funds Be Used for Homeschooling? Understanding 529 Plan Options for Homeschool and How Funds Apply

Exploring educational options outside the traditional classroom often leads families to consider homeschooling. As a homeschool mom and small business owner, I understand how vital it is to maximize every resource. If you’re curious whether a 529 college savings plan can support your homeschool journey, you’re not alone. This blog provides a clear explanation of 529 plans, addresses common questions about their flexibility for homeschoolers, and highlights practical steps for parents seeking alternative ways to make the most of education savings.

Key Highlights

- 529 plans offer tax-advantaged savings for education but have limited flexibility for covering homeschool expenses.

- Qualified expenses typically include college tuition, fees, books, and some dual enrollment or online programs.

- Federal law restricts direct use of 529 funds for most homeschool costs, though some states offer added flexibility.

- A new bill signed into law, changes 529 plan rules as early summer in 2025

- Each state has unique rules; staying updated on local laws is essential for maximizing 529 plan benefits.

- Organized expense tracking and regular plan reviews help homeschool families optimize savings and avoid compliance issues.

What is a 529 Plan and How Does It Work?

For many homeschool families who want flexible options for their children’s education, understanding the basics behind a 529 plan is essential. With the landscape of tuition, education savings, and qualified expenses constantly shifting, homeschool parents are asking how these college savings accounts work and if they can benefit students outside the traditional classroom. Navigating the details of a 529 account, including how funds are contributed, managed, and ultimately put to use, can empower homeschooling families to make more informed choices. This section sheds light on how the account operates and why it matters for parents invested in home-based learning.

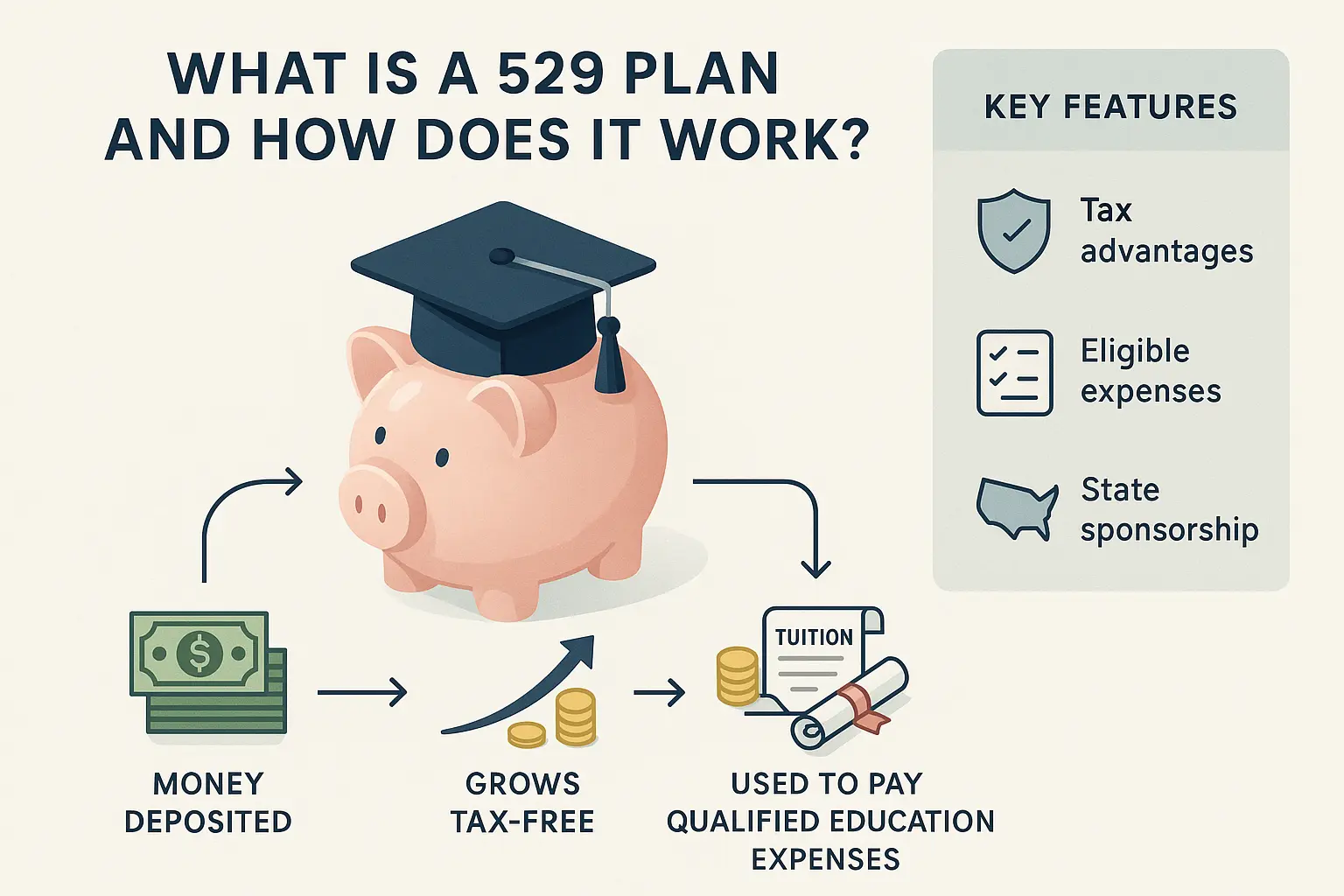

Basics Every Homeschool Parent Should Know About a 529 Account

For homeschool families who value both academic freedom and financial planning, knowing the ins and outs of a 529 savings plan is an important starting point. A 529 plan is a dedicated college savings program created to help parents, grandparents, and even students themselves set aside money for future education costs. Unlike regular savings accounts, 529 accounts offer special tax advantages. That means your invested funds can grow over time, and you won’t pay federal taxes on qualified withdrawals used for education. This advantage makes a 529 savings plan a popular option for families looking to ease the financial burden of higher education for their students, even those who aren’t following the traditional path.

When you open a 529 account, you’re choosing a flexible way to manage educational expenses as your children grow. These accounts can usually be set up by anyone, I’ve found the greatest value in being the account owner and guiding how these funds are used. The account is linked to a beneficiary, typically your child, and you can make contributions over the years as savings allow, these deposits are then invested, so as the years pass, your college savings fund can potentially grow.

What makes the 529 plan especially attractive to homeschool families is the control it offers. You can choose among investment options that suit your personal risk tolerance, some prefer slow-and-steady growth, while others want the opportunity for higher returns. Families benefit from this flexibility, as it lets you adapt your plan to your unique educational approach, whether your students are on a traditional, hybrid, or fully homeschooled journey.

Of course, the main goal of a 529 savings plan has always been to fund future college costs, but as a homeschool mom who’s also an engineer by training, I appreciate the structured, efficient way a 529 account can be aligned with our educational objectives. Contributions can add up over time, so even small amounts saved each month can turn into significant support when your students pursue advanced learning. Plus, the funds aren’t just locked into one option: if one child decides not to use the account, you can change the beneficiary or transfer the funds to another family member, giving even more flexibility to homeschool families.

Another benefit, as families explore if homeschooling expenses qualify, is the ability to track and plan for what kinds of costs are covered under the plan. Currently, most 529 accounts are designed to cover qualified higher education expenses such as tuition, fees, and textbooks, though it’s important to keep an eye on changing regulations and state-specific rules about what constitutes a qualified expense for homeschooled students. For now, being familiar with your state’s approach and any recent updates can help you maximize the opportunities available through your account.

For families wanting to give their children every chance to thrive, inside or outside the traditional system, a 529 college savings plan is a smart foundation. If you’d like to see how this type of account can fit into your unique homeschooling lifestyle, consider speaking to a local advisor who understands both state laws and the homeschool landscape. Take the next step by exploring how you can set up and contribute to your own 529 fund today, and keep an eye out for evolving state and federal policies that could give homeschool families even more ways to leverage these plans in the near future.

Understanding Qualified Expenses for 529 Funds

Deciphering which education expenses a 529 plan covers can be especially challenging for homeschool parents dedicated to maximizing both learning opportunities and their college savings. These plans were originally crafted with traditional tuition and education expenses in mind, but the landscape is evolving. Determining what qualifies as an allowable use of 529 funds, like tuition, school expenses, and specific programs, matters for families who want to stretch every dollar. Understanding these qualified expenses not only protects your savings and account but also ensures you’re fully equipped to support your student’s journey, whether through homeschool courses or college-bound pursuits.

Which Education Expenses Can Be Applied Toward Homeschool?

One of the first questions parents have when setting up a 529 is which education expenses count as “qualified” under the plan’s guidelines. Traditionally, a 529 plan was designed to support college tuition, fees, and other higher education expenses, but many homeschool families are now exploring whether these funds can be used for expenses related to homeschool programs, courses, or even certain homeschool expenses that parallel private or public school costs.

When it comes to homeschool education, the definition of qualified expenses is shaped by both federal regulations and your individual state’s approach. At the federal level, “qualified expenses” for 529 plans are fairly specific. These typically include tuition for college, university, or certain eligible post-secondary programs, plus expenses for required fees, books, supplies, and equipment. For instance, if your student is dual enrolled in a college course or part of an accredited online program that falls under recognized institutions, 529 funds may cover those education expenses, helping to bridge the time between homeschooling and college-level study.

However, it’s crucial to remember that not all homeschool expenses will meet the threshold for qualified expenses under current law. Regular homeschool curriculum purchases or general educational materials, like basic textbooks, online subscriptions, or field trips, aren’t always considered allowable by 529 plan administrators. The distinction often lies in whether your student is formally enrolled in an eligible program and if the expenses are directly tied to tuition or required for the completion of a specific course of study.

Some states have taken a more flexible approach, allowing 529 funds to be used for K-12 tuition at private or religious schools, and a few are starting to recognize certain homeschool co-op tuition or hybrid program fees as potential qualified expenses. Still, for most families, direct tuition payments to a recognized program or institution remain the clearest example of a “qualified expense.” It’s also important to retain clear documentation of all your expenses, having detailed records can prove invaluable if your plan administrator or state agency ever seeks evidence that your withdrawals were indeed dedicated to approved education expenses.

I view this as a systems problem: every family should establish a methodical process for identifying, documenting, and tracking any education or homeschool expenses they hope to reimburse with 529 savings. Set up digital folders or spreadsheets to distinguish tuition, school expenses, and extracurricular courses that might fit the definition of a qualified expense. As a business owner, I recommend reviewing state guidance at least annually, since laws and qualified expenses can change, especially as more families campaign for broader recognition of diverse education paths.

For those committed to homeschooling and strategic financial management, it’s wise to approach your 529 account as both an education fund and a long-term investment in your child’s future. Seek out advice from financial professionals who understand the nuances between state and federal law, and don’t hesitate to ask your plan’s administrator for written clarification on allowable expenses. By combining vigilance, tracking your homeschool expenses, and advocacy, keeping up with changes to what constitutes qualified expenses, families can make every dollar in their college savings fund truly count. And if you find your state lagging behind, your experiences and well-documented expenses can even help influence better policies for homeschool students in the years to come. Stay proactive, organized, and resourceful, so your students can receive the best education possible with every resource you’ve carefully saved.

Current Opportunities and Limitations for Homeschooling with 529 Funds

As regulations shift and more families choose home-based education, it’s important to understand what current federal law allows, and restricts, when it comes to using 529 plan funds for homeschooling. Many parents seek clarity on which education expenses qualify, how a 529 savings plan can address homeschool tuition, and where the limitations lie compared to traditional or private school settings. This nuanced picture helps families navigate opportunities to maximize their savings, while staying mindful of federal and state restrictions. Here, we’ll unpack how the current landscape shapes the practical use of your account so your homeschool student’s education is fully supported.

As regulations shift and more families choose home-based education, it’s important to understand what current federal law allows, and restricts, when it comes to using 529 plan funds for homeschooling. Many parents seek clarity on which education expenses qualify, how a 529 savings plan can address homeschool tuition, and where the limitations lie compared to traditional or private school settings. This nuanced picture helps families navigate opportunities to maximize their savings, while staying mindful of federal and state restrictions. Here, we’ll unpack how the current landscape shapes the practical use of your account so your homeschool student’s education is fully supported.

How Funds Can Be Used for Homeschool Families Under Federal Regulations

Federal regulations expressly state that 529 funds are primarily intended to cover “qualified” education expenses for a college, university, or approved post-secondary institution. Traditionally, these plans were designed with college tuition and certain related costs in mind. Since the 2017 tax reforms, some new opportunities have emerged: 529 funds can now be used for up to $10,000 per year toward tuition at a public, private, or religious K-12 school. However, for most homeschool families, there’s a notable limitation, homeschooling costs generally do not qualify unless you reside in a state that treats homeschool programs as private schools for tuition purposes. That means regular curriculum fees, general homeschool expenses, or day-to-day materials often fall outside what can be covered by 529 plans at the federal level.

Still, there are useful opportunities within these boundaries. If your homeschool student is dually enrolled in an accredited college or post-secondary program while still in grades 7–12, the cost of tuition, textbooks, and required technology could fall within the “qualified” category. This opens a window for families creatively blending home education with early college courses, which is becoming more common as homeschoolers seek academic acceleration or specialized instruction. The same guidance applies if your family’s education plan includes standardized test fees or programs with formal tuition payable to an eligible school, as long as you document expenses accurately and work with your savings plan administrator to confirm eligibility.

Homeschool families must remain vigilant. Keep in close contact with your plan provider, watch for policy updates, and equip yourself with the documentation you may need if eligibility challenges arise. If your ultimate goal is to leverage every savings plan opportunity for your student’s success, staying informed on federal regulations, and how they apply to your educational choices, is a key step in making sound, future-focused decisions for your family and your small business. And as the landscape keeps evolving, homeschool parents and advocates continue to push for broader integration and expanded recognition of diverse education expenses as qualified uses of 529 funds. Be proactive, strategic, and ready to make the most of your education savings, no matter which road your student’s learning path takes.

Enhanced 529 plans as of 2025

On July 4th, 2025, President Trump signed a tax package “One Beautiful Bill Act” (OBBBA), with some of the following provisions for 529 plans:

- A new Kids’ Savings Program called the MAGA account. While this is NOT a 529 plan, this account can be used for saving for your kids’ education. You can read more about it here.

- Increased K-12 Withdrawal Limit. Currently, families can withdraw up to $10,000.00 per year for elementary or secondary education. The law expands the limit to $20,000.00.

- Expanded K-12 Qualified expenses to also include non-tuition costs such as:

- Online educational materials

- Curriculum materials

- Tutoring or educational classes outside of the home

- Dual-enrollment fees for college courses taken in high school

- Fees for nationally standardized tests

- Specialized strategies designed to support students with disabilities

These 529 costs can be taken without federal tax worries; however, this expansion of K-12 benefits may require new legislation on a state-by-state basis, as not all states currently consider K-12 expenses as qualified expenses for tax purposes.

State-Level Differences in 529 Plan Usage for Homeschoolers

Understanding 529 plan funding options for homeschoolers calls for attention not only to federal law but especially to individual state differences. Each state brings its own approach to how these plans, accounts, and education expenses are defined and managed, directly shaping what’s possible for homeschool families. The right guidance is essential as rules on tuition, qualified expenses, and homeschool programs shift from one state plan to another. From tuition flexibility to recognizing specific homeschool expenses, it’s crucial for families to stay informed and proactive, finding up-to-date guidance to make the most of their state-level opportunities while planning their child’s education.

Navigating State Laws and Finding Accurate Guidance for Your Family

For homeschool parents determined to maximize their child’s education, the nuances of state-level 529 plan rules can either empower or confound your saving strategy. States have considerable latitude in structuring their plans, and that means families must look past general advice and get hyper-local with their research and decision-making.

As a homeschool mom juggling the responsibilities of engineering and small business ownership, I’ve witnessed firsthand how dramatically opportunities and restrictions can shift when you cross state lines. For instance, some state plans permit account holders to use 529 funds for K–12 private school tuition up to a federal limit, while a handful may interpret “school” expansively enough that certain homeschool program fees or co-op tuition are included. Still, most states stick closely to the minimum federal requirements and do not extend qualified status to homeschool tuition or everyday homeschool expenses, which can catch families off guard if they’re not reading the fine print.

What adds to the complexity is that state education departments and 529 plan administrators frequently update their official guidance, sometimes with little notice. A well-intentioned family could open an account and design an education plan around now-eligible homeschool expenses, only to discover a year later that the state has changed its policy or clarified the law in a less favorable direction. That’s why it’s critical to not only monitor your state’s plan but also to seek written guidance or clear confirmation from the program administrator. Don’t just rely on phone conversations or online FAQs, get your questions answered in writing, especially if you’re planning to use your account for non-traditional expenses associated with your child’s schooling.

Many families benefit from contacting a local expert, such as a tax advisor who specializes in state education funding or an advocacy group embedded in the homeschool community. These professionals can break down how your state’s laws interact with your family’s needs, clarify the gap between what’s technically “qualified” and what’s commonly, but mistakenly, assumed to be allowed. If your state plan has flexibility, they’ll help you structure your expenses so you don’t lose out on eligible tuition payments for qualified programs. Conversely, in a restrictive state, they can help strategize ways to maximize college savings and appropriately earmark each account for post-secondary education.

It’s also wise to join local and state-level homeschool networks. Families often share real-world experiences about what’s worked with the account process, which education expenses passed muster, and how their state’s definition of school or programs evolved over time. This collective knowledge can be invaluable, helping you avoid costly mistakes or missed opportunities.

Practical Tips for Maximizing Your Plan Benefits While Homeschooling

Homeschooling with a 529 plan can feel like navigating uncharted waters, but the right strategies bring clarity and confidence to maximizing your benefits. By intentionally tracking education expenses, organizing your account documentation, and staying proactive, homeschool parents can make every dollar in their savings count. It’s not just about what you spend, but how you manage and justify those expenses that unlock the plan’s true potential. In the following sections, you’ll discover practical methods for documenting homeschool expenses and keeping your 529 account organized, setting your family up for lasting educational success.

Strategies for Tracking Expenses and Keeping Your Account Organized

Start by constructing a checklist of potential education expenses allowed by your plan and your state’s rules. This list may include tuition for eligible online courses, dual enrollment fees, and required books, essential for homeschool families looking to maximize savings. Documenting each of these expenses is practical not just for plan compliance, but for your own peace of mind. I recommend keeping digital copies of receipts, invoices, and account statements in a secure, cloud-based folder labeled “529 Plan Expenses.” By separating categories, college tuition, required textbooks, technology, or any qualifying homeschool program tuition, you make future reporting effortless and thorough.

Expense-tracking apps or customizable spreadsheets are especially useful for busy parents who juggle teaching, running a small business, and managing family finances. Record every transaction, even if you aren’t sure it will qualify. Include the date, amount, account number, purpose, and any supporting documents. This information can save you significant hassle when reviewing your account, seeking reimbursement, or providing proof of compliance to your plan administrator. Many families set aside monthly time to reconcile these records with their account’s transaction history, ensuring there are no surprises down the line and that no allowable expense is overlooked.

Pay special attention to the nuances of your plan rules, some states require even more rigorous documentation if you use funds for homeschool tuition or co-ops described as eligible schools. Each state’s plan outlines which expenses can be covered, so align your tracking system with those definitions. If your family uses hybrid or supplemental homeschool programs, distinguish those expenses from non-qualifiable purchases, like general curriculum or enrichment field trips. This detail prevents accidental misuse of funds and keeps your plan in good standing.

As a business owner, I also recommend creating year-end summaries that break down all expenses tied to your 529 account, listing those used for qualified education expenses and those that didn’t meet plan requirements. This not only assists with recordkeeping for taxes or potential audits but offers valuable insight for future savings strategies, helping to maximize the benefits of the account moving forward. Set up reminders to periodically review state plan updates and add new qualifying expenses to your checklist as laws shift.

Engage your older students in the process too. Teaching your children practical skills like tracking their own education-related expenses prepares them for future financial responsibility, a lesson that pays dividends beyond homeschooling. If your plan allows for direct payments from the account to service providers, make a separate log so you can cross-reference disbursements against receipts. For families managing multiple students or accounts, color-code folders or labels to avoid mixing up education expenses, ensuring clarity and accurate reporting at tax time.

Ultimately, staying organized is about protecting your savings and ensuring every qualified dollar works for your student’s unique educational pathway. Consistent tracking, diligent documentation, and deep familiarity with your state’s 529 plan details enable you to maximize plan benefits, optimize account usage, and provide your students with the educational experiences you’ve envisioned, all while embodying the disciplined, resourceful spirit of homeschooling. If you haven’t already, start today by creating a new expenses folder, reviewing your state’s current plan rules, and celebrating each step toward a more empowered, well-managed homeschool education future.

As you plan your homeschool journey, understanding how 529 funds can support your goals is key to maximizing your family’s educational budget. Staying informed about current legislation and available qualified expenses can help you make smart choices. If you’re ready to explore flexible homeschool solutions or need help navigating education savings, contact me if you have any questions about navigating this system.